- #NEW PAN CARD CORRECTION FORM FREE DOWNLOAD PDF MANUAL#

- #NEW PAN CARD CORRECTION FORM FREE DOWNLOAD PDF REGISTRATION#

- #NEW PAN CARD CORRECTION FORM FREE DOWNLOAD PDF SOFTWARE#

- #NEW PAN CARD CORRECTION FORM FREE DOWNLOAD PDF CODE#

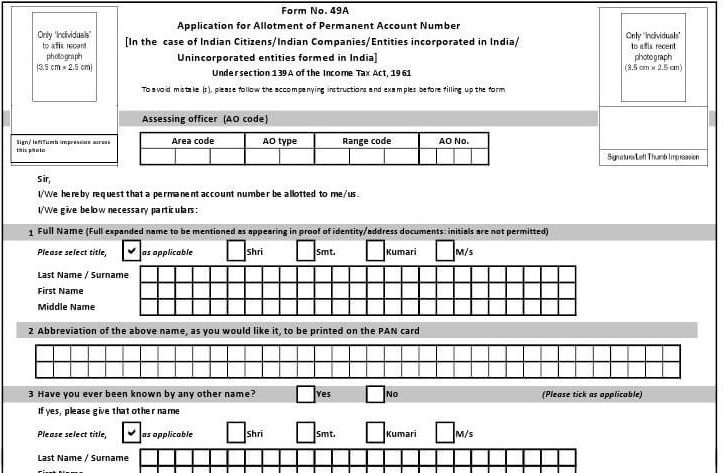

A PAN card will keep track of how much tax you pay.PAN cards can be used as ID cards in different schemes or for different reasons.It is important when you pay income tax, get a tax refund, or hear from the Income Tax Department.Taxpayers need a Permanent Account Number because it is needed for all financial transactions and is used to keep track of how much money comes in and how much goes out.Besides, it is a mandatory document to have for the completion of several following procedures, including:. In many situations, the Permanent Account Number is a very important way to prove who you are. Continue reading to find out more information about the application procedure! Agneepath Yojana If you wish to apply for a PAN Card, you should be aware that the application forms that are required by each of the entities on the list are distinct from one another. PAN for the Hindu Undivided Family (HUF).How Many Different Types of PAN Cards Exist? 1995 marked the conclusion of this series. Initially, PAN numbers were assigned manually, and to prevent duplication, each ward/circle was assigned a distinct range of numbers. In 1976, all tax-paying people were required to get a PAN number, which was before optional. The Indian government rolled out the PAN system in 1972. Due to the fact that the GIR is not unique, there is a greater possibility of miscalculations, mistakes, and incidents of mistaken identity during tax assessment.

#NEW PAN CARD CORRECTION FORM FREE DOWNLOAD PDF MANUAL#

This was mostly a manual method that was specific to a particular ward or a single examining authority. Prior to the introduction of the PAN, taxpayers were allotted a GIR number. Protean e-Gov Technologies Limited runs TIN-Facilitation Centres and PAN Centres all over the country to help people get their PAN Cards. The Income Tax Department gives out Permanent Account Numbers with the help of UTI ITSL and NSDL, which are authorized PAN agencies at the district level. After the app scans the QR Code, the applicant must agree not to misuse the data.

#NEW PAN CARD CORRECTION FORM FREE DOWNLOAD PDF SOFTWARE#

The software allows the camera to read the PAN Cardholder’s information from the QR Code. The applicant doesn’t require a login or registration.

#NEW PAN CARD CORRECTION FORM FREE DOWNLOAD PDF CODE#

#NEW PAN CARD CORRECTION FORM FREE DOWNLOAD PDF REGISTRATION#

The DOB is changed to the company’s registration date and the cardholder’s name to the company’s name.

0 kommentar(er)

0 kommentar(er)